Are you actually on track for EPC B?

With the consultation edging closer, many commercial property portfolios are still being managed using outdated EPC data and reactive decision-making.

On paper, assets may appear compliant today. In reality, many portfolios are quietly drifting off course, with CapEx deployed too late, EPCs renewed at the wrong time, and leasing decisions made without a clear view of future risk.

The question is no longer “are we compliant now?”

It is “are we structurally set up to reach EPC B?”

Compliance alone is not a strategy

Meeting minimum MEES thresholds in isolation does not equal readiness. A portfolio that is genuinely preparing for EPC B has visibility across risk, timing and opportunity, not just ratings.

That means understanding, at portfolio level:

Which assets are already non-compliant or moving towards risk

Which EPCs no longer reflect current building performance

Which properties are vulnerable to future MEES thresholds

Where EPC validity clashes with lease events, renewals or disposals

Where earlier intervention could materially improve outcomes

Without this visibility, EPC decisions tend to be made too late to influence capital planning or asset strategy.

The hidden risk of reactive EPC management

We still see EPCs being renewed simply because they are expiring rather than because it is strategically the right moment, with CapEx then being spent only after ratings have already limited leasing flexibility. Similarly, assets are upgraded without a clear understanding of whether EPC timing is working for or against them, while whole portfolios continue to rely on historic assessments that no longer reflect how buildings actually perform.

From compliance to portfolio intelligence

Rather than managing EPCs asset by asset, future-ready portfolios treat energy performance as portfolio intelligence, bringing together performance, risk and timing into a single strategic view.

When this information is structured properly, asset managers gain clarity on:

Where to prioritise spend

Where EPC action can wait

Which assets are driving future risk

Whether the portfolio is genuinely moving towards EPC B

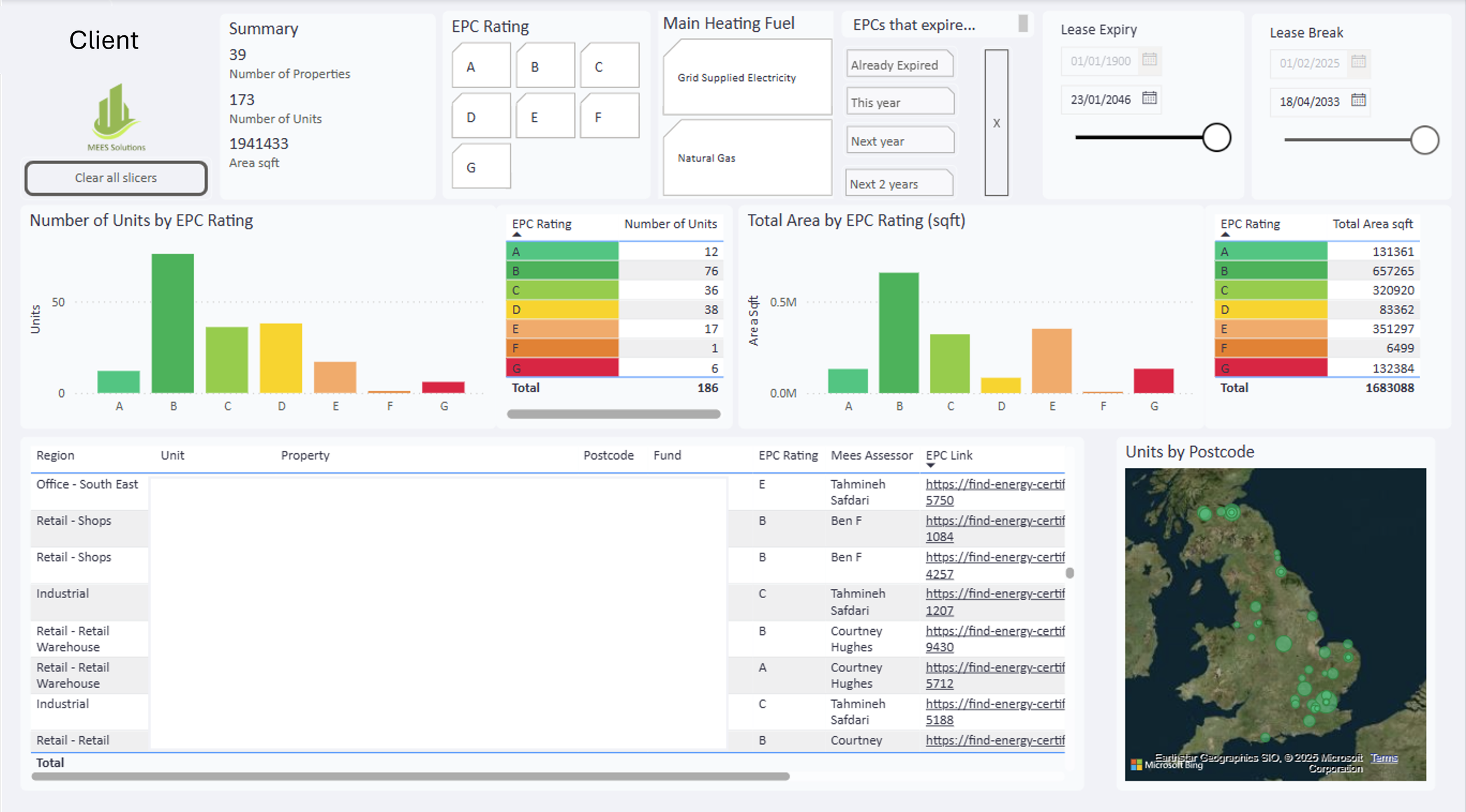

A portfolio-wide view of EPC ratings, expiry dates and lease events, produced by MEES to support the clients EPC B strategy and CapEx planning.

Why timing now matters

At this stage, the challenge is not being ahead of the game. It is about being on track.

Portfolios that wait until EPC B becomes a hard regulatory deadline will be forced into compressed programmes, limited options and higher delivery risk.

It is advantageous to renew EPCs now and lock-in ratings that are valid for 10-years, before the reduced validity period is introduced. This also reduces the number of mid-tenancy EPC renewals that will need to be completed, if ‘an EPC is required at all times’ is legislated.

A realistic capacity and cost risk the industry cannot ignore

If a large proportion of the market delays action until the latter part of the decade, demand for EPC assessments, surveys and improvement works is likely to rise sharply over a short period.

The commercial property sector has experienced similar capacity pressures during previous regulatory-driven cycles. Specialist assessors and, critically, contractors delivering improvement works are not an unlimited resource, and scaling capability takes time.

A concentrated surge in demand could realistically result in:

Longer lead times for assessments and surveys

Reduced flexibility around delivery programmes

Increased competition for contractor availability

Greater delivery risk where works are time-critical

In parallel, sustained demand pressure typically places upward pressure on capital improvement costs, particularly where specialist labour, materials or equipment are required.

While EPC assessment costs themselves may remain relatively stable, the cost and availability of improvement works are more exposed to market-wide demand fluctuations.

Why early structure matters

Portfolios that establish visibility and prioritisation earlier are better positioned to:

Phase works over realistic timeframes

Align EPC improvements with planned refurbishments and CapEx cycles

Reduce reliance on last-minute contractor availability

Limit exposure to cost escalation driven by market congestion

So, what next?

If you are short on time, working with incomplete EPC data, or unsure where to start with a particular asset or portfolio scenario, there are a few simple ways we can help.

We provide three complimentary resources to support EPC B planning:

2026 Planning Toolkit

Portfolio-level strategy, EPC timing risk, the impact of upcoming carbon-factor and regulatory changes, plus a 2026 readiness checklist to help identify where hidden risk already sits across your assets. Available to download here.Strategy meeting

A structured session to review your property or asset list, EPC position, and upcoming risk, so priorities and CapEx can be set with confidence. EnquireCPD sessions

Practical sessions for asset and property teams covering how EPCs, MEES and future thresholds affect real-world decisions, delivered in person or remotely. Enquire